Mt.Gox to Compensate BTC

Updated · 11:43:28 Author: Block Explorer 2023

Coin World News: Creditors of the Mt.Gox bankruptcy case have been waiting for over 10 years and have finally seen the light of compensation. According to the latest news, the physical distribution of Bitcoin (BTC) and Bitcoin Cash (BCH) will begin in July this year. This article will analyze in detail the specific details of this compensation, market expectations, and the potential impact on the cryptocurrency market.

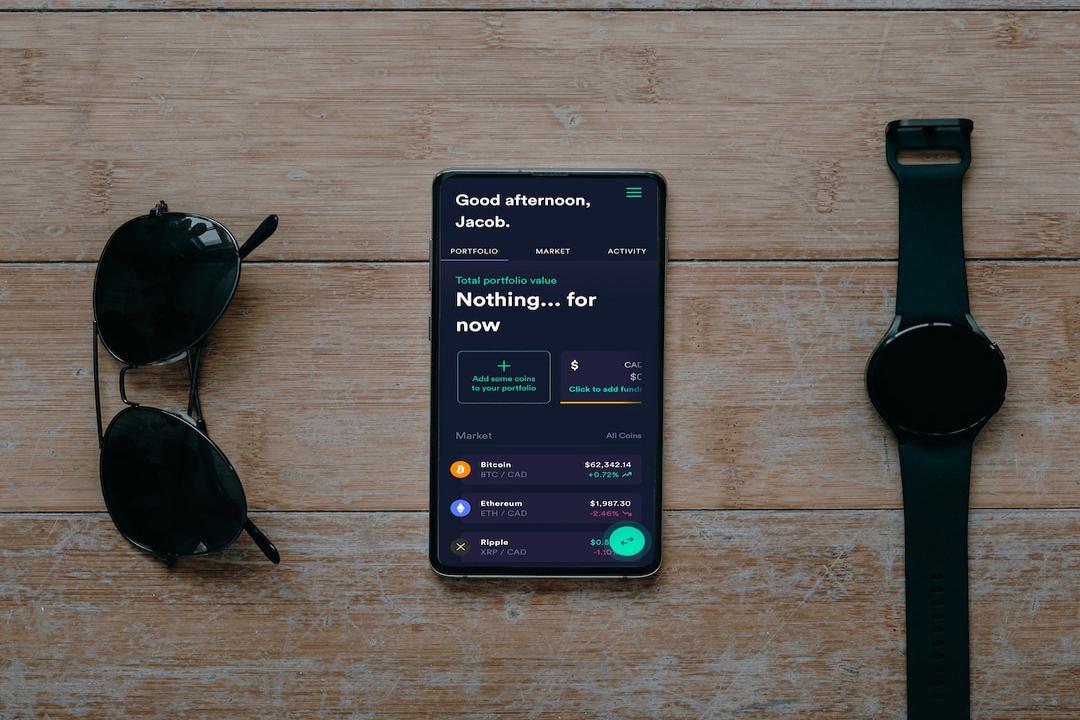

Bitcoin BTC latest price today

Ranking

Currency name

Dollar price

$

24H change

Circulating market value

$

Initial issue price

24h high price

24h low price

1

BTC

Bitcoin

$62,042.19

1.4%

121.94 billion

$0.0025

$62,449.82

$60,662.69

Bitcoin BTC trend chart

K line

Trends

All

24H

7 days

30 days

Nearly three months

Nearly a year

All

24H

7 days

30 days

Nearly three months

Nearly a year

Mt.Gox Compensation BTC Distribution Details

1. History of Mt.Gox

Mt.Gox was once the world’s largest Bitcoin exchange, but declared bankruptcy in 2014 due to a hacker attack, with about 940,000 Bitcoins (valued at $424 million at the time) stolen. After years of legal proceedings and asset recovery, Mt.Gox only recovered 15% of the Bitcoins, about 141,868, which are now worth about $9 billion in the market.

2. Early Compensation Plan

In order to receive compensation as soon as possible, many creditors chose the early compensation plan and accepted about a 10% reduction. We estimate that about 75% of Bitcoin creditors chose this option, totaling about 95,000 Bitcoins for early compensation.

3. Compensation Distribution

Of the 95,000 Bitcoins for early compensation:

20,000 will go to the rehabilitation fund

10,000 will go to Bitcoinica BK

65,000 will go to individual creditors

This is far lower than the reported 141,868 Bitcoins.

Analysis of Bitcoin Selling Pressure

1. Creditors’ tendency to hold

Although the market is generally concerned about large-scale Bitcoin selling pressure, we believe that this pressure may be lower than expected for the following reasons:

Long-term holders: Creditors are mostly early Bitcoin adopters who are technically savvy and tend to hold for the long term.

Resistance to the fund’s offer: Creditors have resisted the aggressive offers made by the rehabilitation fund over the years, indicating a preference to hold Bitcoin rather than receive cash compensation.

Capital gains impact: Since the bankruptcy, Bitcoin prices have risen 140 times. Even with only 15% of physical recovery, creditors have gained significant dollar-denominated returns, reducing the incentive to sell.

Even if only 10% of the 65,000 Bitcoins are sold, this means that 6,500 Bitcoins may enter the market. These Bitcoins will be allocated to creditors’ accounts at Kraken, Bitstamp, or Bitgo, and most individuals will directly deposit them into their trading accounts.

2. Fund’s holding intention

Through communication with some of the rehabilitation funds, we understand that the investors in these funds are mostly high-net-worth Bitcoin holders, rather than credit funds engaged in arbitrage trading. Although some limited partners may choose to sell, we believe that the overall selling pressure will not be significant.

Bitcoin Cash (BCH) Selling Pressure

1. Creditors’ interest in BCH

Compared to Bitcoin, the selling pressure on BCH may be greater. The main reasons are:

No initial purchase: Creditors did not actively purchase BCH, but received the forked coins from Bitcoin held by Mt.Gox.

Low liquidity: The market liquidity of BCH is much lower than that of Bitcoin, especially on Kraken and Bitstamp, where the liquidity is only 1/60 of Bitcoin’s.

2. Market impact

Due to the low liquidity and lower market demand for BCH compared to Bitcoin, a large amount of BCH is expected to be sold quickly after distribution, further reducing its market price.

Conclusion

Although the upcoming compensation plan for Mt.Gox has raised concerns about selling pressure on Bitcoin and BCH, the actual situation may not be so severe. Based on our analysis:

Bitcoin: Due to the long-term holding tendency of creditors, combined with the significant impact of capital gains, the selling pressure on Bitcoin may be lower than market expectations.

BCH: Due to the lack of initial purchase motivation and lower liquidity, the selling pressure on BCH will be greater than Bitcoin, and its market performance may be more affected.

Investors need to remain vigilant and closely monitor market dynamics and compensation progress. At the same time, obtaining the latest data and analysis through the Coin World APP will help make wiser investment decisions during this market volatility.

Mt.Gox Popular News

Mt. Gox to Begin Repayment in July, BTC Falls Below $61,000

The defunct cryptocurrency exchange should return over 140,000 Bitcoins to victims of the 2014 hacker attack. …

Mt. Gox Prepares for Refund, Bitcoin Faces Downward Pressure

Considering the daily RSI has plummeted to oversold territory, the price of Bitcoin may suddenly drop significantly. …

After Mt. Gox’s Statement, Bitcoin Touches Below $59,000, $3,130,900,000 Clearing Impact on the Cryptocurrency Market

Adjustments are deepening for Bitcoin (BTC) and the cryptocurrency market, as there have been reports that the former cryptocurrency exchange Mt.Gox is implementing a plan to distribute digital assets worth about $9 billion. …

Mt. Gox to Start Repaying Creditors Next Month Amid Bitcoin Miner Sales

Mt.Gox is set to start distributing payments to creditors next month, as reports of Bitcoin miners selling their BTC surface. …

Mt. Gox Announces Payments for Bitcoin, Bitcoin Cash Next Month

The cryptocurrency industry is no stranger to hacking, and the Mt.Gox incident shocked the entire market. This notorious hack. …

Mt. Gox Prepares to Pay Off BTC and BCH Users

Mt.Gox, a cryptocurrency exchange, lost 850,000 Bitcoins in 2024 and will begin repaying its collapsed users. The rehabilitation trustee announced that the payments will be made in Bitcoin. …

How Will Mt.Gox’s $9.4 Billion BTC Affect the Market?

Mt.Gox’s repayment plan may affect the BTC market and raise some worrisome questions. …

Related Posts

Add A Comment