Ethereum’s recent upgrade, Dencun, promised to accelerate its performance and reduce costs. However, the price of Ether didn’t receive the memo and instead took a sharp decline. It’s like planning an impressive entrance to a party, only to stumble at the doorstep.

The price behavior of Ether after the upgrade resembled the classic “buy the rumor, sell the news” scenario. The cryptocurrency experienced a significant rally, surpassing the $4,000 mark for the first time since December 2021. However, the week ended with Ether losing 7.5% of its value.

According to CryptoQuant, Ethereum was pricing itself at its highest level since the peak in 2021. On the day of the upgrade, the market value to realized value (MVRV) ratio for Ether was at a lofty 2.0. In simpler terms, Ethereum was twice as expensive as what the average investor paid for it, resulting in unrealized gains of around 50%. Despite ending the week just below $3,600, the upgrade itself was not to blame. The network was already bustling with activity, and the supply of Ether was dwindling, reaching its lowest point since August 2022.

The technical aspects of Wednesday’s upgrade were impressive. The network activity and supply dynamics were positive, and the Ether supply reached its lowest point just before Ethereum’s transition to proof-of-stake. The high transaction fees led to more fees being burned and a reduction in the Ether supply. It’s as if Ethereum decided to go on a diet by burning off the excess calories from transaction fees. Long-term Ether investors are hopeful that these upgrades will position Ethereum as the leading blockchain platform, surpassing rivals like Solana.

Ether’s performance in 2024, with a 60% gain, was on par with Bitcoin, attracting investors’ attention to the Dencun upgrade and the possibility of Ether ETFs being approved in the US in May. However, despite these positive prospects, Ether’s price took a tumble below the $4,000 mark and struggled to recover.

Currently, Ether is trading at around $3,574, with its market cap slightly affected. Bitcoin, on the other hand, managed to recover over the weekend, leaving Ether in a somewhat gloomy state. However, there is still some positivity amidst the uncertainty. An impressive 89% of Ether holders are still in a profitable position, showcasing resilience in the face of market volatility.

Analyzing the on-chain data, it becomes evident that the $3.7K mark is a significant resistance level, with a substantial amount of Ether held by approximately 991,000 addresses. It’s like a financial fortress, indicating a strong barrier for any price increase. As market observers navigate support and resistance levels, the $4,000 mark stands as a psychological hurdle to overcome.

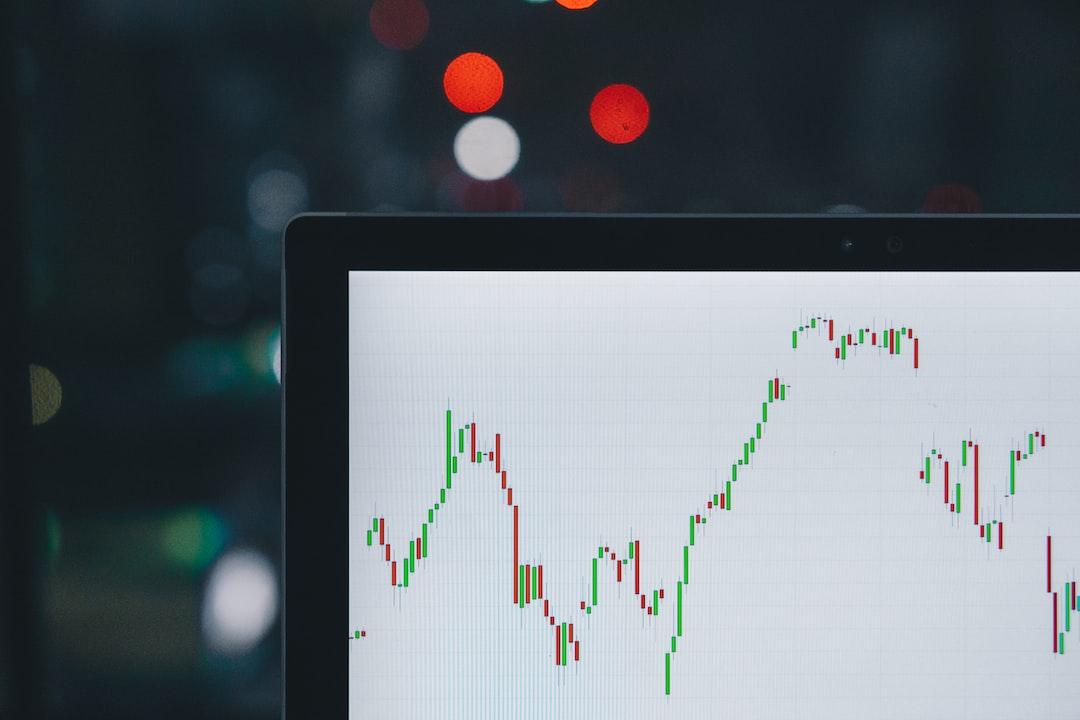

On the charts, Ether is struggling to surpass the $3,700 mark and the 100-hourly Simple Moving Average. Resistance near $3,650 is posing a challenge, and Ether needs to overcome this obstacle to shake off the bearish sentiment. Looking ahead, if Ether manages to break through these hurdles, we could see a rally towards $3,925 and potentially a flirtation with the $4,000 resistance level once again.

On the flip side, if Ether fails to gather enough strength to overcome the resistance, we may witness a retreat to lower levels of support, with key levels at $3,520 and $3,500. If the bears gain momentum, Ether could find itself in a more challenging position, potentially sliding further down the slope.