CoinWorld reports:

Source: Dao Shuo Blockchain

1. Are We Entering a Prolonged Bear Market?

During this period, the market has been persistently sluggish, causing many investors to feel quite low emotionally. Personally, I find it all rather dull. As for whether this situation will persist and lead into a long bear market, I can’t predict. However, it does remind me of the conditions toward the end of the last bear market cycle.

I recall writing in an article around the first half of 2020: At that time, I couldn’t see much innovation in Ethereum applications or signs of significant external capital inflows. Therefore, I believed that even if a bull market were to follow, it might not be very strong; Bitcoin’s peak was likely between $20,000 and $50,000.

But just a few months later, a miracle happened: Compound issued governance tokens, the liquidity mining model emerged, and DeFi officially ignited a frenzy, marking the spectacular beginning of the last bull market.

Sometimes, miracles happen unexpectedly.

In my view, the cryptocurrency ecosystem is the most innovation-friendly, accessible, and likely to produce miracles among all high-tech ecosystems in the world today. I believe the next miracle in the cryptocurrency ecosystem will surely come.

Therefore, despite the current bleak market conditions, in this vibrant and energetic cryptocurrency ecosystem, let’s not lose faith. Even if we have to endure a long period of hardship in this bear market cycle, as long as we hold our ground, when the miracle comes again, patience and perseverance will surely be rewarded.

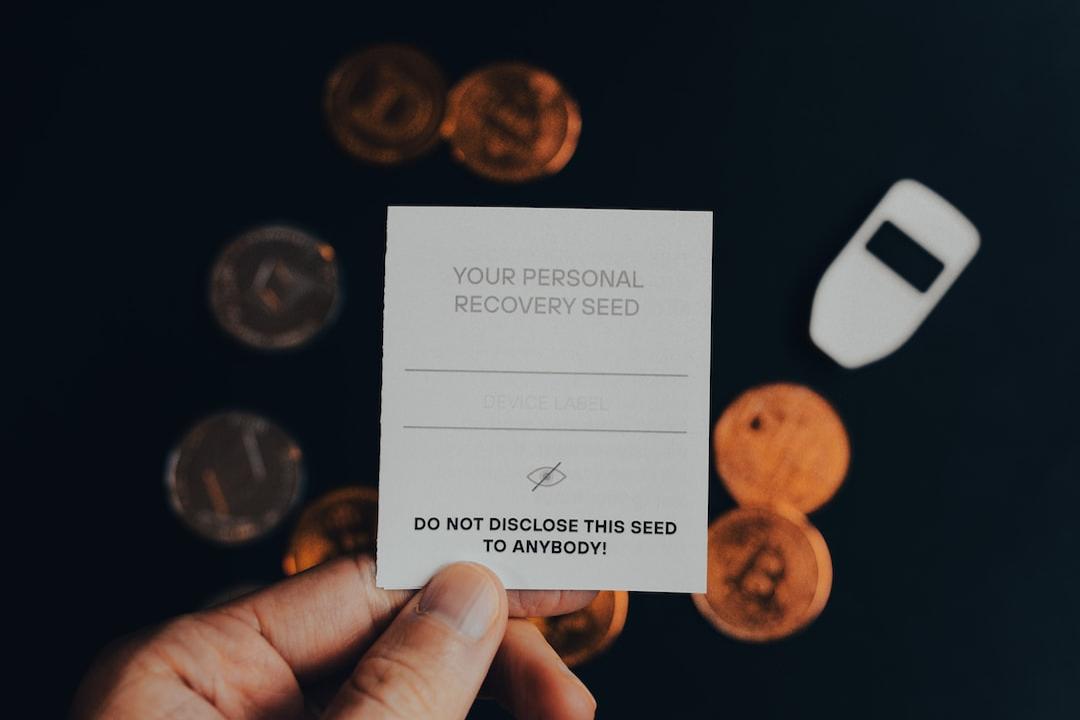

2. Which Cold Wallet Is Recommended? How About the OneKey Brand’s Cold Wallet?

I won’t recommend a specific cold wallet. Both I and my friends use OneKey as well as ImToken.

3. Is There Any DeFi for the Fuel?

This is a modular blockchain and a unique extension system within the Ethereum ecosystem, focusing on scalability solutions for Ethereum executions. I have also participated in some operations on this blockchain.

4. Does Vitalik Still Have Plans for Sharding?

Based on Vitalik’s writings over the past year or two, he hasn’t mentioned much about sharding development. So, in the short term, I believe his focus won’t be on sharding. His emphasis on second-layer scaling will likely be on enhancing interoperability between second-layer scaling solutions and addressing issues between them.

5. Can Linea and Scroll Still Be Profitable?

I occasionally engage with these extensions when I have time, but I avoid operations like POH in Linea; I’m quite averse to such things.

6. What Are the Prospects for ORDI? Is It Worth Buying Around $50?

Regarding ORDI, I still think that once the bull market arrives, ORDI’s performance could potentially be leveraged like Bitcoin’s. I wouldn’t buy at around $50. A while back when it was in the $30s, I bought some.

7. How About MATIC?

I think the Matic team has consistently performed well. They have launched several projects, and their developed ZK CDK is increasingly being used by more projects to create new ZK second-layer extensions. So, I haven’t been too concerned about its price; apart from exchanging some Matic for OP and ARB recently, I’ve held onto the rest.

8. How Is Magic? The Team Has Been Active Recently, with Positive Developments.

The positive development I know of is mainly the project team’s work on developing Ethereum’s second-layer scaling. This indeed seems like a worthwhile path forward. In the current environment, I don’t see a better way to boost project spirits.

9. How Are SATS Doing?

I haven’t sold any of this coin; I’ve held onto them all and plan to sell them in the next bull market.