Source: Dao Said Blockchain

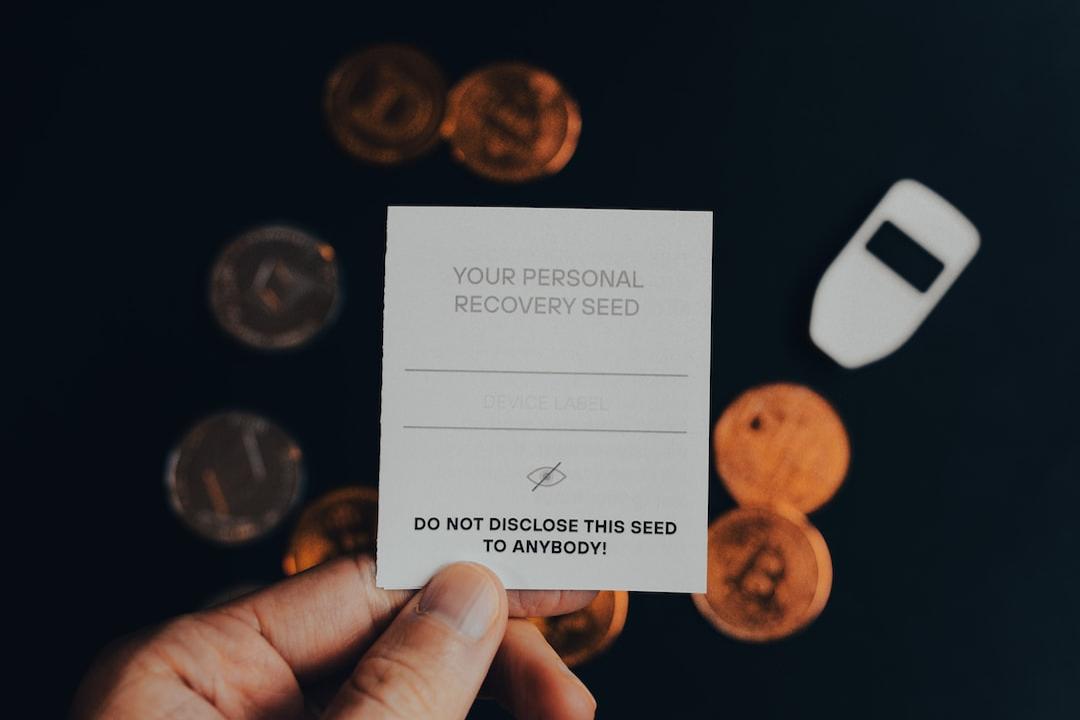

1. About Cold Wallets

I have written some detailed articles about cold wallets before, and there are many similar articles on the internet. You can search for them.

2. Which Cold Wallets Support Merlin Chain?

As far as I know, it seems that there hasn’t been any dedicated cold wallet product that supports Merlin Chain yet.

But in reality, we can create a wallet that is close to being “cold”.

A key feature of a cold wallet is that it is offline.

For ordinary users, a simple method is to use a secure computer, install wallet software, and then disconnect the computer from the internet. This makes it close to being a “cold” wallet.

This wallet should not connect to the internet unless absolutely necessary (such as for making external transfers). Even if it does connect, it should not open any websites, but only the wallet for transaction operations.

3. Can CKB Be a Target for Regular Investment?

So far, apart from the coins I have invested in regularly, I haven’t invested in other coins, and I won’t be investing in CKB for now.

I suggest being cautious when choosing a target for regular investment.

4. Is There a Better Allocation for Idle Funds?

I don’t think buying anything now is worthwhile.

Take Bitcoin and Ethereum for example, my regular investment prices for them were $35,000 and $2,500. But now they have exceeded $60,000 and $3,300. Based on my regular investment prices, I cannot buy at the current levels.

Although the prices of other coins are not high, and some are even relatively low, I find it difficult to judge their future potential. So even if the prices are not high, I don’t think it’s a good idea to buy them.

I also have idle funds now, and apart from buying some ORDI some time ago, I haven’t bought anything else.

When my regular investment prices for Bitcoin and Ethereum were exceeded, I would use some idle funds to participate in new projects that I really liked. But now I haven’t found any new projects that I really like.

Just let the idle funds stay idle, it’s better than using them recklessly.

If investors really can’t stand idle funds and feel uncomfortable not using them, then all I can say is to buy Bitcoin and Ethereum if you can’t resist, and try to avoid touching others as much as possible.

5. My Positions in Bitcoin and Ethereum have always accounted for 60%. Is the premise that the other 40% of my positions have always kept pace with the fluctuations of the 60% positions? What if the 40% positions rise? What if the 40% positions fall?

The percentage I mentioned in the article is based on the initial investment capital.

For example, when I decided to make regular investments in a bear market, if I have $10,000, I will use at least $6,000 to make regular investments in Bitcoin and Ethereum, and the remaining $4,000 or less will be used to buy other coins.

After buying these coins, as long as their teams and projects are not significantly problematic, I won’t care whether their prices rise or fall, I will continue to hold them until I decide to cash out in a bull market.

6. How about XXX Coin?

This is a question that many readers often ask in the comments. Many of these coins I haven’t even heard of, or even if I have, I know very little about them and cannot judge their potential value and prospects.

My time, energy, and funds are all very limited, and combined with my obvious ecological bias, I mainly focus on Ethereum infrastructure (mainnet, layer-2 scaling, some side chains, various extensions of Ethereum functions) and coins in the Ethereum ecosystem, as well as some well-known projects in the Bitcoin ecosystem.

I have almost no interest in the non-Ethereum ecosystem coins (except for AR) and airdropped coins in the Bitcoin ecosystem. Some of these coins I do have, but that’s purely from airdrops, and I basically don’t track their development or have a hard time judging their potential value. I just hold on to them until the bull market for cashing out.