The past week has felt like a bear market to me, and I believe many of you feel the same. Yes, cryptocurrency prices have dropped, but more importantly, the current market atmosphere is quite dull.

However, with the change of seasons and the Gan time factor we are dealing with, I believe that this will soon change. If you haven’t watched our Wednesday update, I suggest you do so here.

Let’s get straight to the point, as my feelings have not changed.

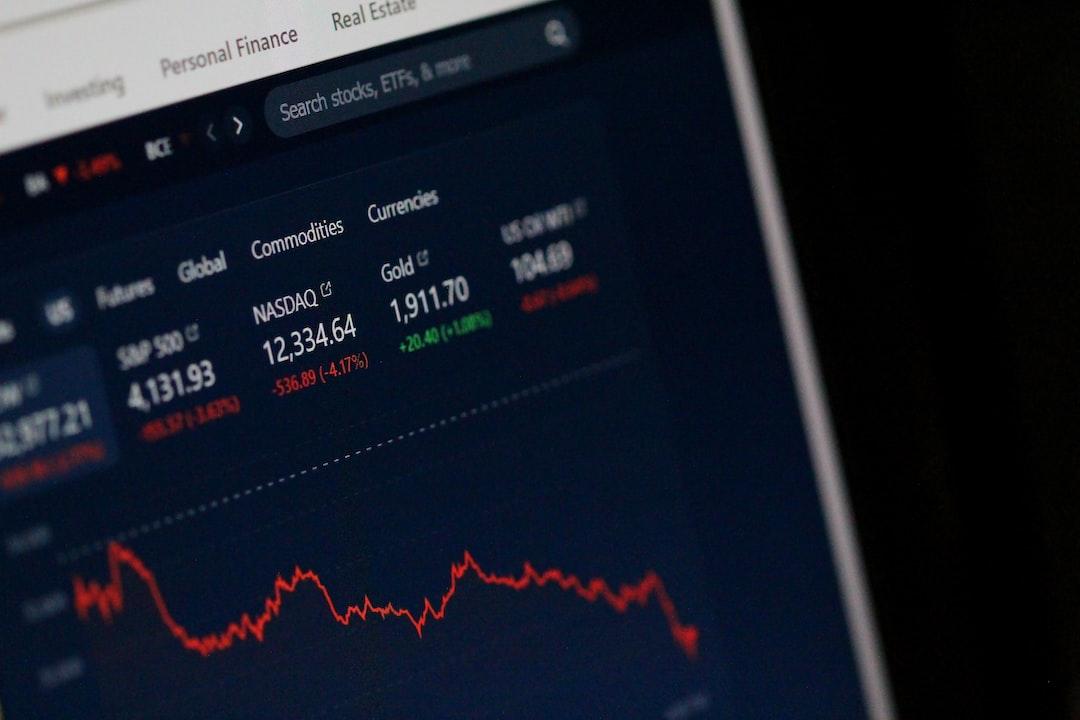

First, let’s take a look at the stock market.

We need to be prepared for a pullback buy. As you can see, we have two symmetrical uptrends. Each trend is 20 calendar days (not trading days), exactly 310 points. Thus, the two symmetrical trends in time and price coincide with the red line marking the 150-degree date of the SPY IPO. The red line has arrows indicating the date calculated by degrees last time, and you can also see that this is a short-term high.

We also note that many people have pointed out that the RSI of QQQ is at a historically high level.

All of this coincides with the natural date of the summer solstice.

This tells us to be prepared for a trend change. The good news is that our election cycle seasonality still tells us that the market still has room to rise, as shown in the graph above. We also have the next natural date on July 7th, which is a Sunday, but it would perfectly coincide with a 10-day adjustment before the next natural date if we adjust here, potentially reaching a low point near the next natural date.

As for cryptocurrency, the setup is almost identical, but in the opposite direction.

Similarly, our natural date is coming tomorrow, coinciding with the price. Note the daily RSI in the orange circles, marking the low points. We also have a bullish reversal setup, as indicated by the blue arrows, where the price is making higher lows while the RSI is making lower lows. This tells us that BTC is oversold in the short term. Coupled with the price being right at the intersection of the green 1/1 uptrend line and the black 1/1 downtrend line, and close to our date, I believe this is at least a significant low point in the short term.

On the other hand, ETH is showing stronger performance than BTC.

I encourage you to watch the video from Wednesday, where I discussed signals and timing. As you can see, we are performing better than BTC and still maintain a three-day reversal. Therefore, if this market takes off, ETH is expected to perform well.

Finally, let’s review the teaching points from last week.

Last week, I demonstrated on several meme charts how to find bottoms.

Here are last week’s TRUMP charts with the actual results.

As you can see, many meme charts look like this. The key is that when the chart forms a lower high followed by a lower low, panic is guaranteed. So do not buy on the second rebound, and sell if it breaks the low of the first adjustment. Another key point is to wait for three declines to complete before buying. Then look for the signal candle.

Here’s another good example. The current leading meme BASE’s CHOMP.

I can almost guarantee it will retest the $0.25 level. It broke through, formed a lower high, and then a lower low. There will be panic. Buy at this point.

This is important, as many charts look like this, and many people keep trying to guess and buy the bottom. Forget it. In fact, if you know these things, the bottom is easier to find. Wait for three declines, then wait for the signal candle. This way, you now have a safer way to buy the bottom. Stop guessing.

So, while I am optimistic about the rebound in the coming days/weeks, be cautious about buying such charts. TRUMP will be a good study, with the upcoming debates. For me, it looks like it still needs one more decline, so the key is to see if it forms a higher high during the debate week. If not, there will be panic buying.

It’s that simple. For those altcoins that have been falling for weeks, magnify to the weekly chart, look for a three-decline structure, and then wait for the signal candle on the weekly chart. This will be safer than trying to buy the bottom.

Overall, I believe we are at a turning point. Get ready for the rebound, but don’t bet all your assets. We are still in a very difficult and volatile market, which may continue until August.